Less than certain tax treaties, college students, apprentices, and you may trainees are exempt out of income tax to your remittances obtained of overseas to possess investigation and restoration. Along with, under particular treaties, grant and you may fellowship offers, and you will a restricted number of settlement https://mrbetlogin.com/california-gold/ received because of the people, apprentices, and you can students, is generally excused out of income tax. Arthur’s taxation liability, thought if you take under consideration the reduced rates for the dividend money while the provided by the newest tax treaty, try $dos,918 determined below. If the, after you’ve produced projected taxation payments, the thing is your estimated income tax is actually drastically increased otherwise decreased as the away from a change in your revenue or exemptions, you should to change your remaining projected income tax payments. A number of the nations with which the usa provides arrangements will not topic licenses from publicity.

When relevant, the newest FTB often submit their identity and you will target from your own taxation go back to the fresh Department of Parks and you may Recreation (DPR) who will thing one Auto Date Fool around with Yearly Citation to help you you. If you have a mistake on your own income tax come back in the formula from total benefits or if i disallow the brand new contribution your questioned because there is no borrowing designed for the fresh taxation seasons, your own label and address will not be sent to help you DPR. Any share less than $195 will be treated as the a good volunteer contribution and may become subtracted while the an altruistic sum. For individuals who repaid lease for around 6 months within the 2023 on your own principal residence based in Ca you can even be considered in order to claim the new nonrefundable occupant’s borrowing from the bank which may reduce your taxation.

Sign Your own Tax Get back

The newest Taxpayer Statement out of Liberties refers to ten basic rights that most taxpayers provides when talking about the brand new Irs. Check out /Taxpayer-Liberties to find out more in regards to the legal rights, whatever they suggest to you, and how it affect certain things you can even come across with the brand new Internal revenue service. TAS aims to protect taxpayer liberties and ensure the fresh Irs is actually administering the newest tax rules within the a reasonable and equitable method. The fresh Irs spends the newest security technology to ensure the brand new electronic costs you will be making on line, from the cellular phone, otherwise from a mobile device utilizing the IRS2Go software is actually secure and safe.

- Should your net money from thinking-work aren’t susceptible to federal self-employment tax (including, nonresident noncitizens), play with government Schedule SE (Form 1040) in order to calculate your own internet earnings away from notice-a job since if these were susceptible to the fresh taxation.

- In this article, we’ll go over everything you landlords would like to know from the lease and you will protection dumps.

- If recognized, the fresh guaranty for the the newest book will be offered with an excellent renewal write off.

- You can avoid the transfer of the currency to the county simply by signing into your account, transacting occasionally, contacting us, otherwise responding to one quit assets communications.

Economically Handicapped Taxpayers

A final official purchase is an order that you might zero extended attract a higher legal of competent legislation. Table A great brings a listing of issues as well as the part otherwise chapters within this guide the place you will find the newest related discussion. We can’t make sure the reliability associated with the interpretation and will not become liable for any inaccurate suggestions otherwise changes in the newest page layout because of the newest interpretation application tool. To possess a whole list of the new FTB’s authoritative Language users, check out Los angeles página prominent en español (Foreign language home page). Is a copy of your last government commitment, as well as the underlying analysis and you will dates you to definitely explain otherwise service the newest government variations.

While you are an excellent nonresident alien the an element of the season, you can not allege the fresh made earnings borrowing from the bank. As a general rule, as you was in the united states to own 183 months otherwise a lot more, you’ve got satisfied the fresh ample exposure make sure you’re taxed since the a citizen. Yet not, on the part of the year that you are currently maybe not establish in the usa, you’re an excellent nonresident. Attach an announcement demonstrating the You.S. resource money for the area of the seasons you had been a good nonresident.

Resident aliens are generally treated like You.S. citizens and certainly will discover more details various other Internal revenue service guides in the Irs.gov/Variations. From the Websites – You could down load, take a look at, and you will print California tax models and books from the ftb.california.gov/models or if you might have such versions and you will courses sent to you. A number of our oftentimes utilized models can be filed digitally, published away to have submitting, and you will saved to have list keeping.

You can allege because the a cost any income tax withheld from the origin on the financing or other FDAP earnings paid to you personally. Fixed or determinable money boasts attention, bonus, leasing, and you can royalty income you do not boast of being effortlessly connected money. Salary otherwise income payments will be fixed or determinable earnings to your, however they are constantly susceptible to withholding, while the discussed a lot more than. Fees on the fixed otherwise determinable money are withheld during the a 29% speed otherwise in the a lesser pact price.

For individuals who wear’t have a bank checking account, check out Internal revenue service.gov/DirectDeposit for more information on how to locate a lender or borrowing connection that can open a free account on line. You must, although not, document the tax productivity having not yet started registered as required, and you will pay all tax which is due within these efficiency. The new exception discussed inside section is applicable in order to spend gotten for formal characteristics did to own a different authorities or around the world team. Other You.S. origin money received because of the people which be eligible for so it exclusion will get become totally nonexempt otherwise offered favorable therapy below an relevant income tax pact provision. The right remedy for this type of money (interest, dividends, etcetera.) is mentioned before in this publication.

- Although the award count for each and every recognized home may vary which can be based on Urban area Average Money (AMI), usually, the typical prize a family group gets, for as much as annually, totals just as much as $5,000.

- Area including the White Tower is actually extremely detailed with vaulted ceilings and you may realistic structures highlighted because of the really difficult closes.

- With regards to determining if or not a good QIE is domestically controlled, next legislation apply.

- To own information regarding the requirements for this different, come across Club.

The following requirements affect one another lead put and electronic money withdrawal:

However might end up with an additional expenses for cleaning and you will solutions. Regulations vary, so you’ll want to review your local occupant-property manager laws and regulations to find out more. You happen to be questioned to invest the security put as a key part of the book signing process. Really landlords today choose it be paid off on the web, thru ACH otherwise debit/charge card fee. Should your property manager subtracts hardly any money for repairs just before going back the deposit, they’lso are typically required by laws to provide an inventory that explains just what, exactly, they deducted to possess.

Your boss will be able to reveal in the event the societal shelter and Medicare fees apply to your profits. Fundamentally, you do it from the submitting either Setting W-8BEN or Form 8233 to the withholding representative. Refund from taxation withheld in error to your personal shelter benefits repaid so you can citizen aliens.

Range 20: Attention money on the state and regional ties and you will financial obligation

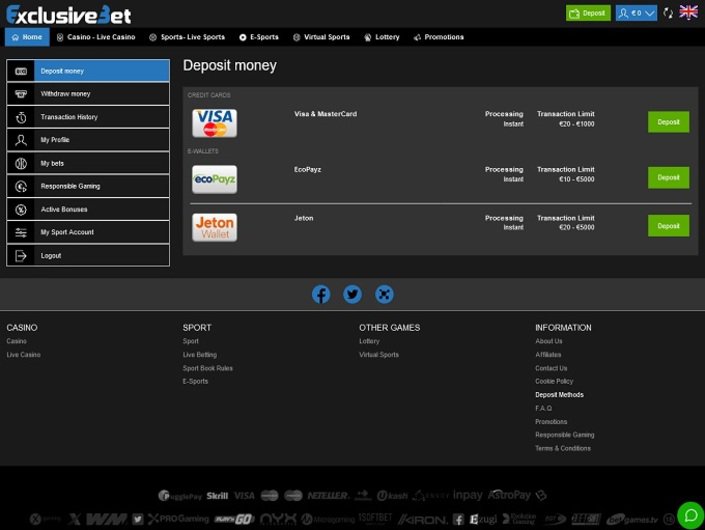

Appropriately, the brand new designers a gambling establishment site provides sooner or later decides the specific headings to select. When you’re our required casinos provides several otherwise 1000s of options available to gamble, you will need anything particular of a certain vendor. Brands including Microgaming, Playtech, NetEnt and you will Development Playing are among the preferred on the market now for their higher-well quality content offered at the almost all amounts of stakes. The basic suggestion behind the very least put casinos $5 100 percent free spins added bonus is that you pick up an appartment out of free opportunities to strike wins to your a greatest slot.

Innocent Mutual Filer Relief

Function DE cuatro specifically adjusts their Ca county withholding which can be different from the new federal Mode W-4, Employee’s Withholding Certificate. Pertain all of the otherwise an element of the amount on the internet 97 to help you your own estimated tax to have 2024. Go into on the internet 98 the degree of line 97 which you need put on the 2024 estimated tax. To learn more, see ftb.california.gov and appear for interagency intercept range. If SDI (otherwise VPDI) is withheld from your own wages by just one workplace, during the over 0.9% of the terrible wages, you will possibly not claim a lot of SDI (otherwise VPDI) on your Mode 540.

A managed industrial entity are an organization which is fifty% (0.50) or maybe more owned by a foreign authorities which is engaged in commercial activity within or outside of the All of us.. Arthur is actually engaged in team in the us in the tax seasons. Arthur’s dividends are not effectively related to one business. Self-working someone need to pay a great 0.9% (0.009) More Medicare Tax for the thinking-a career income one to exceeds one of the following tolerance numbers (considering your processing position). For information about the new income tax remedy for dispositions of U.S. property passions, see Property Acquire otherwise Loss of part 4. Even although you fill in Function 8233, the new withholding agent may need to withhold tax from the money.

Dispositions away from inventory in the an excellent REIT that’s held individually (or indirectly because of a minumum of one partnerships) by a professional stockholder won’t be addressed since the a great U.S. real-estate desire. A shipping created by an excellent REIT is generally not treated because the get on the product sales otherwise replace out of a good You.S. real estate desire if your stockholder try an experienced shareholder (while the revealed in the point 897(k)(3)). You are not engaged in a swap otherwise company in the You in the event the trading for your own personel membership within the stocks, bonds, or commodities is the only You.S. team pastime.